San Diego Homes Newsletter

Your Home Sold Guaranteed, or I'll Buy It!*

What’s Your Home Worth?

Maximize your profit and convenience with flexible options:

✅ Sell For Top-Dollar

✅ Quick, Hassle-Free Cash Offers

✅ Flexible Commissions – Starting at 1%

📞 Call/Text George Lorimer at 619-846-1244

Struggling to find the right home?

Find Hidden & Off-Market Homes

My VIP Homefinder Service gives you access to off-market and unlisted homes that aren’t online.

There is no obligation, and I cover all marketing costs. Just text me your target areas!

🔍 Search Homes Now

📩 Let’s discuss your best options! Call or text 619-846-1244.

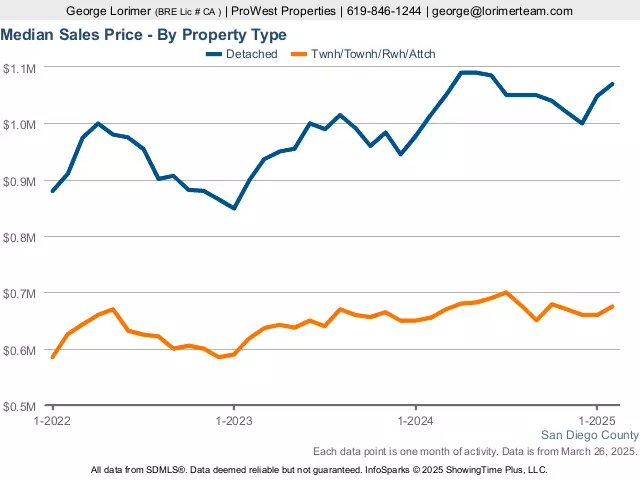

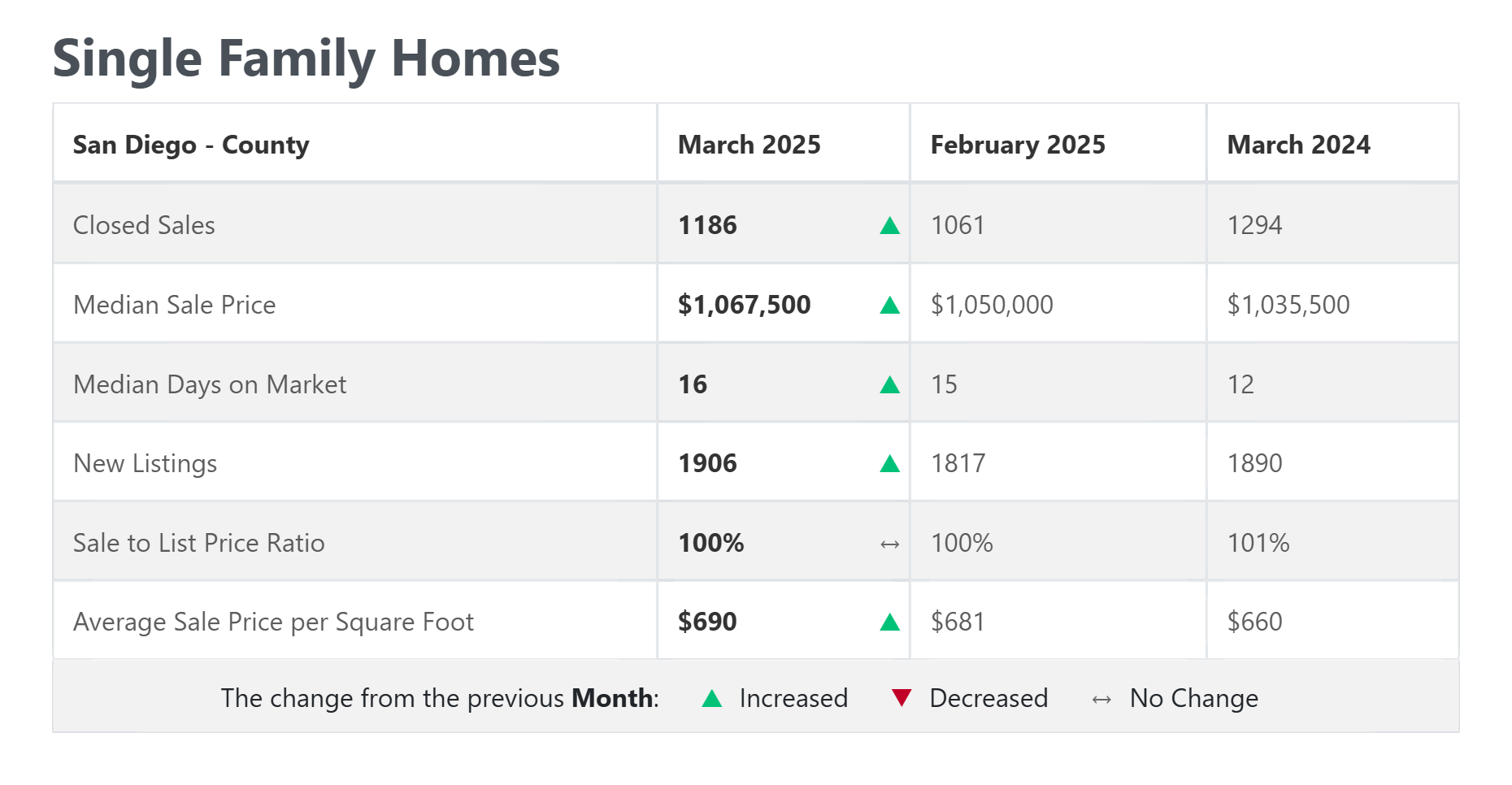

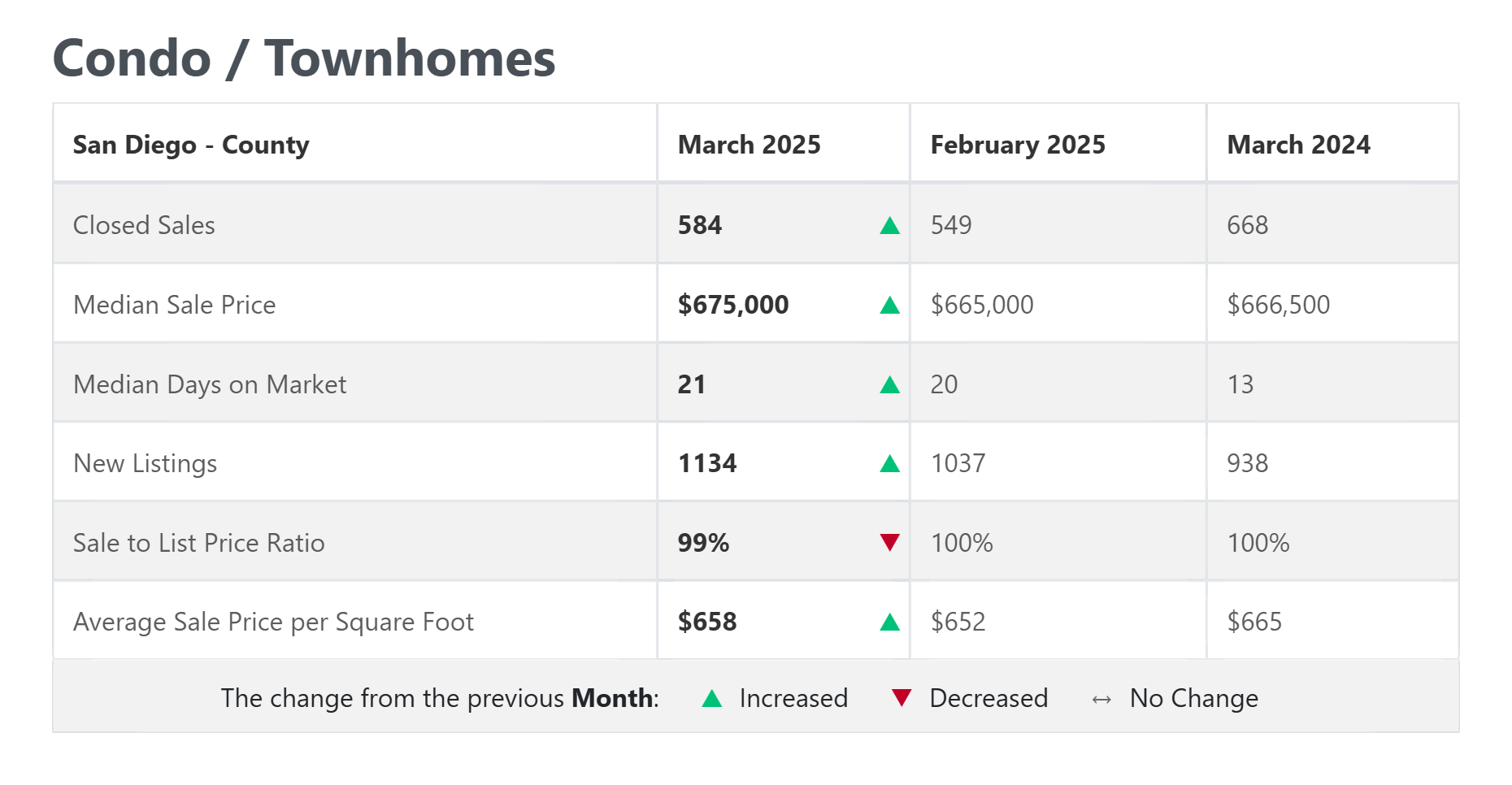

San Diego County Housing Summary - April 1, 2025

- The active listing inventory in the past couple of weeks soared by 213 homes, up 5%, and now sits at 4,756, its highest late-March level since 2020. For March, 3,531 new sellers entered the market in San Diego County, 1,348 fewer than the 3-year average before COVID (2017 to 2019), 28% less. Last March, there were 2,913 new sellers, 18% fewer than this year. Last year, there were 2,752 homes on the market, 2,004 fewer homes, or 42% less. The 3-year average before COVID (2017 to 2019) was 5,846, or 23% extra.

- Demand, the number of pending sales over the prior month, rose by 110 pending sales in the past two weeks, up 6%, and now totals 1,946. Last year, there were 1,889 pending sales, 3% less. The 3-year average before COVID (2017 to 2019) was 3,403, or 75% more.

- With demand rising slightly faster than supply, the Expected Market Time, the number of days to sell all San Diego County listings at the current buying pace, decreased from 74 to 73 days in the past couple of weeks. It was 44 days last year, substantially faster than today. The 3-year average before COVID (2017 to 2019) was 52 days, also faster today.

- In the past two weeks, the Expected Market Time for homes priced below $750,000 decreased from 80 to 74 days. This range represents 32% of the active inventory and 32% of demand.

- The Expected Market Time for homes priced between $750,000 and $1 million decreased from 57 to 54 days. This range represents 21% of the active inventory and 29% of demand.

- The Expected Market Time for homes priced between $1 million and $1.25 million increased from 57 to 64 days. This range represents 10% of the active inventory and 11% of demand.

- The Expected Market Time for homes priced between $1.25 million and $1.5 million increased from 63 to 65 days. This range represents 9% of the active inventory and 10% of demand.

- The Expected Market Time for homes priced between $1.5 million and $2 million increased from 73 to 87 days. This range represents 9% of the active inventory and 8% of demand.

- In the past two weeks, the Expected Market Time for homes priced between $2 million and $4 million decreased from 108 to 106 days. For homes priced between $4 million and $6 million, the Expected Market Time decreased from 196 to 172 days. For homes priced above $6 million, the Expected Market Time decreased from 471 to 453 days.

- The luxury end, all homes above $2 million, accounts for 19% of the inventory and 10% of demand.

- Distressed homes, both short sales and foreclosures combined, comprised only 0.4% of all listings and 0.6% of demand. Only eight foreclosures and nine short sales are available today in San Diego County, with 17 total distressed homes on the active market, down seven from two weeks ago. Last year, 12 distressed homes were on the market, similar to today.

- There were 1,650 closed residential resales in February, down 7% from February 2024’s 1,783 closed sales. February marked a 12% increase compared to January 2024. The sales-to-list price ratio was 99.3% for all of San Diego County. Foreclosures accounted for 0.2% of all closed sales last month, and short sales accounted for 0.1% of all closed sales. That means that 99.7% of all sales were good ol’ fashioned sellers with equity.

Copyright 2025—Steven Thomas, Reports On Housing—All Rights Reserved. This report may not be reproduced in whole or in part without express written permission from the author.

Call/text George Lorimer at 619-846-1244

ProWest Properties, DRE# 01146839, *Conditions apply, Source: Reports on housing summary

Replacing a water heater usually isn't at the top of anyone's to-do list--until it suddenly stops working. But making a quick, last-minute decision can mean missing out on energy-efficient models that save you money in the long run. Whether you're planning a home upgrade or just want to be prepared, understanding your options ahead of time can make all the difference.

For the complete story, click here...25 Smart Tips to Help You Sell Your Home Faster and for Top Dollar

Selling your home can feel like a big task--but with the right strategy, it doesn't have to be stressful. These expert-backed tips will help you attract buyers quickly, negotiate with confidence, and get the best price possible.

More...Everyone makes money mistakes from time to time, but the key to long-term financial success is learning from those missteps and making smarter choices going forward. Many of the most common financial pitfalls can be avoided with a little awareness, discipline, and planning.

More...Choosing the Right Water Heater for Your Home

Replacing a water heater isn't something most homeowners think about--until there's no hot water and you're forced to make a quick decision. But rushing into a replacement can mean missing out on energy-efficient options that could save you money over time. Whether you're planning a home improvement project or simply want to be prepared, learning about your water heater choices now can help you make a smart, stress-free decision later.

There are several types of water heaters available today, each with its own pros and cons. Storage tank water heaters are the most common. They hold 20 to 80 gallons of water and are available in electric, gas, propane, and oil models. Newer units are designed to minimize heat loss and improve energy efficiency. Tankless (on-demand) water heaters, on the other hand, heat water only when needed--saving energy by not storing hot water continuously. They're compact and efficient but may require multiple units in larger households with high water usage.

For those looking for more sustainable options, heat pump water heaters use electricity to draw heat from the air and transfer it to the water. They're incredibly efficient but perform best in warmer climates. Tankless coil and indirect water heaters rely on your home's existing heating system to generate hot water, which can be especially efficient in colder climates where the boiler is used more frequently. Meanwhile, solar water heaters offer a renewable energy option that can significantly lower utility bills in sunny areas, especially when paired with available tax incentives.

When deciding on a water heater, consider how much hot water your household uses during peak times. Instead of just looking at the size of the tank, check the first-hour rating (FHR), which tells you how much hot water the unit can deliver in a busy hour. You'll also want to review the Energy Factor (EF) or Uniform Energy Factor (UEF)--the higher the rating, the more efficient the unit. Look for ENERGY STAR® models to ensure you're getting the most savings.

Also, be sure to factor in the total cost of ownership--not just the purchase price. Installation fees, ongoing maintenance, and monthly energy usage all play a role in how much you'll ultimately spend. In many cases, paying a little more upfront for a higher-quality, longer-lasting unit can save money in the long run. And don't forget to check the warranty--longer coverage often signals better durability and peace of mind.

Bottom line: Taking the time to explore your options now--before an emergency hits--can help you make a more informed, cost-effective decision. Whether you're upgrading your current system or preparing your home for sale, choosing an energy-efficient water heater is a smart investment in your home's comfort and value.

25 Smart Tips to Help You Sell Your Home Faster and for Top Dollar

Selling your home can feel like a big task--but with the right strategy, it doesn't have to be stressful. These expert-backed tips will help you attract buyers quickly, negotiate with confidence, and get the best price possible.

Before You List

1. Know Why You're Selling

Your motivation--whether it's downsizing, relocating, or upgrading--will guide your timeline, pricing, and strategy.

2. Keep Your Reason PrivateDon't reveal your motivation to buyers. It can weaken your negotiating power.

3. Price It RightOverpricing discourages buyers; underpricing leaves money on the table. Use comps and expert insight to find the sweet spot.

4. Know the Market Around YouIn newer subdivisions, comparables are easy. Older, more varied neighborhoods may require expert help with pricing.

5. Check Out the CompetitionVisit local open houses to see how your home stacks up. Take note of features, staging, and pricing.

6. Consider a Pre-Listing AppraisalThis can back up your asking price--especially in a slower or shifting market.

7. Choose the Right Realtor®Don't just go with the first agent you meet. Interview a few, review their marketing plans, and make sure you trust them.

8. Build in Room to NegotiateGive yourself a cushion between your ideal sale price and your list price, so you can negotiate confidently.

Prep Your Home Like a Pro

9. First Impressions MatterClean, declutter, and fix anything broken. Curb appeal counts just as much as the inside.

10. Ask for Honest FeedbackYou might not notice things buyers will. A Realtor® or friend can help spot red flags.

11. Clean Like a ShowroomScrub every surface, clear clutter, and take care of even small repairs. You're competing with new construction, too.

12. DepersonalizeBuyers need to picture themselves living there. Neutral colors and minimal decor work best.

13. Get Rid of OdorsPet smells, food, and smoke can turn buyers off fast. Go for a clean, fresh scent.

14. Disclose EverythingBeing upfront about defects protects you from legal issues later and builds trust with buyers.

Marketing & Showings

15. Attract Multiple BuyersMore interest means more leverage. Great listing photos, online marketing, and strong staging can boost visibility.

16. Stage It to SellEven light staging--like fresh flowers, neutral throws, or good lighting--can boost perceived value.

17. Don't Move Out Too SoonVacant homes can feel cold or forgotten. If you can, leave some tasteful furniture for staging.

Negotiating Offers

18. Know Your BuyerUnderstand their timeline, motivation, and financing situation. That info can help you negotiate smarter.

19. Keep Emotions in CheckThis is a business transaction--stay calm, focused, and strategic.

20. Don't Rush the ProcessDeadlines can make you appear desperate. Give yourself breathing room in case negotiations stretch out.

21. Evaluate All Offers CarefullyEven if an offer seems low, consider it a starting point. Review the details--price, deposit, contingencies, and closing date--before responding.

22. Counter StrategicallyA smart counter-offer shows you're serious but not desperate. This often brings buyers back with better terms.

23. Make Sure the Buyer is QualifiedBefore you commit, confirm the buyer has financing in place and can truly afford the offer they've made.

24. Lock in a Strong ContractMake sure everything is spelled out in writing: deadlines, responsibilities, inclusions, and contingencies.

25. Stick to the TermsOnce you've signed a contract, avoid changes like early move-ins or verbal side deals. It's not worth the risk.

Avoiding Common Financial Mistakes: A Guide to Smart Money Management

Everyone makes money mistakes from time to time, but the key to long-term financial success is learning from those missteps and making smarter choices going forward. Many of the most common financial pitfalls can be avoided with a little awareness, discipline, and planning.

One of the biggest traps people fall into is impulse buying, especially when it's done with a credit card. Making unnecessary purchases without planning often leads to interest charges that add up quickly. While 0% interest promotions can be helpful, they only work if you pay the full balance before the promotional period ends. It's always wise to research large purchases ahead of time and ask yourself if you truly need the item--or if it's just a want.

Closely tied to this is the issue of excessive debt. While credit can be a helpful tool for managing big expenses, it becomes a problem when it's overused. Warning signs like borrowing to pay off other loans or delaying bill payments are red flags that should not be ignored. Prioritizing high-interest debt and using debit or cash when possible can help keep spending in check and protect your financial health.

Another easy mistake to make is missing payment due dates, which can negatively impact your credit score and lead to higher interest rates, declined loan applications, or even missed job opportunities. Setting up reminders or using automatic payments can help you stay on top of your bills. It's also a good habit to regularly review your credit report for errors or suspicious activity.

Many people also get caught up in the idea that having multiple credit cards is beneficial, but too many cards can encourage overspending and complicate financial tracking. Keeping just a few well-managed cards--typically two to four--is usually enough, and helps you maintain a solid credit profile.

Overspending, especially on non-essentials, can derail other important financial goals. Tracking your expenses and creating a realistic budget, whether with an app or a simple spreadsheet, is one of the most effective ways to stay on track. And while budgeting focuses on how you spend, don't forget the importance of saving. Paying yourself first--automatically setting aside a portion of your income for savings--helps build a cushion for future goals and unexpected expenses.

Small but frequent banking and credit card fees--like ATM fees or overdraft charges--can eat away at your money before you realize it. Using your bank's ATMs, monitoring your balance, and recording your transactions can help you avoid these unnecessary costs. Similarly, credit card fees and interest can add up fast. Whenever possible, pay your balance in full and look for cards with low interest rates and generous grace periods.

Ultimately, it all comes down to financial responsibility. Being proactive about your finances--reviewing your bills and bank statements, comparison shopping for better account terms, and addressing issues promptly--can save you time, money, and stress in the long run.

The bottom line: Avoiding common financial mistakes doesn't require perfection--it just takes a little planning and a willingness to stay informed. Whether you're building a nest egg, preparing to buy a home, or simply trying to make smarter day-to-day decisions, these habits can lead to a stronger, more secure financial future.

San Diego County Housing Report: Go for Gold, No Waiting

|